Robo Advisor

Services

API Development and IntegrationTransactional Platforms

Client

Nedgroup Investments

Industries

Investment

Problem

Solution

Project Overview

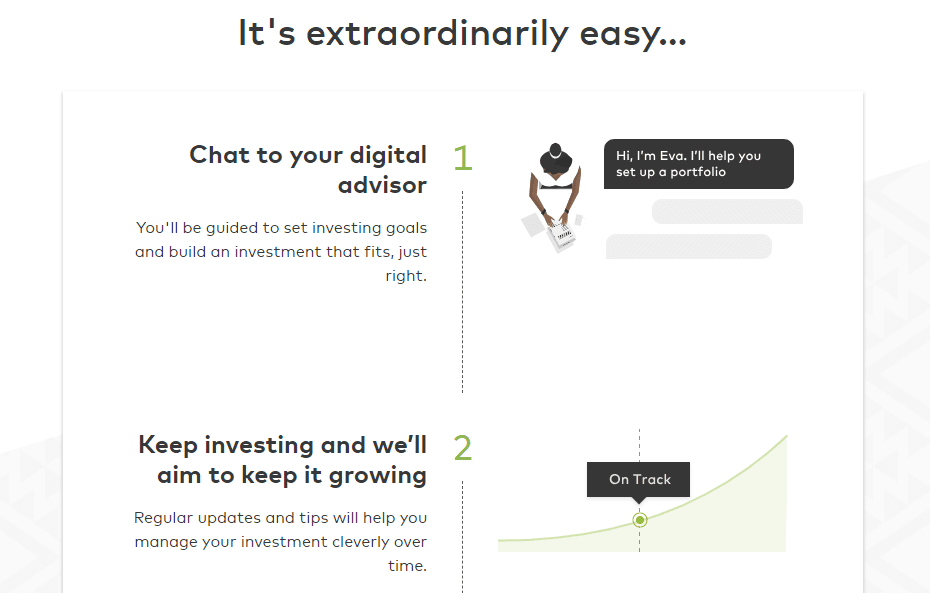

We worked with Nedgroup investments alongside their international project partners, to deliver a digital “Robo” advisor. The advisor was to be integrated with EEE for digital onboarding and with the project partner’s sophisticated algorithms (to provide an investment recommendation).

Chat was to be embedded in the “extraordinary life” website and presented as the first step in investing with Nedbank. https://extraordinarylife.nedbank.co.za/

The digital advisor needed to include mechanisms to set it apart and make an often tedious process feel exciting. Elements such interactive facial analysis software/tool to ‘guess your age’ rather than just asking how old you are were incorporated to make the experience more engaging. Makes capturing details more interesting through mechanisms such as.

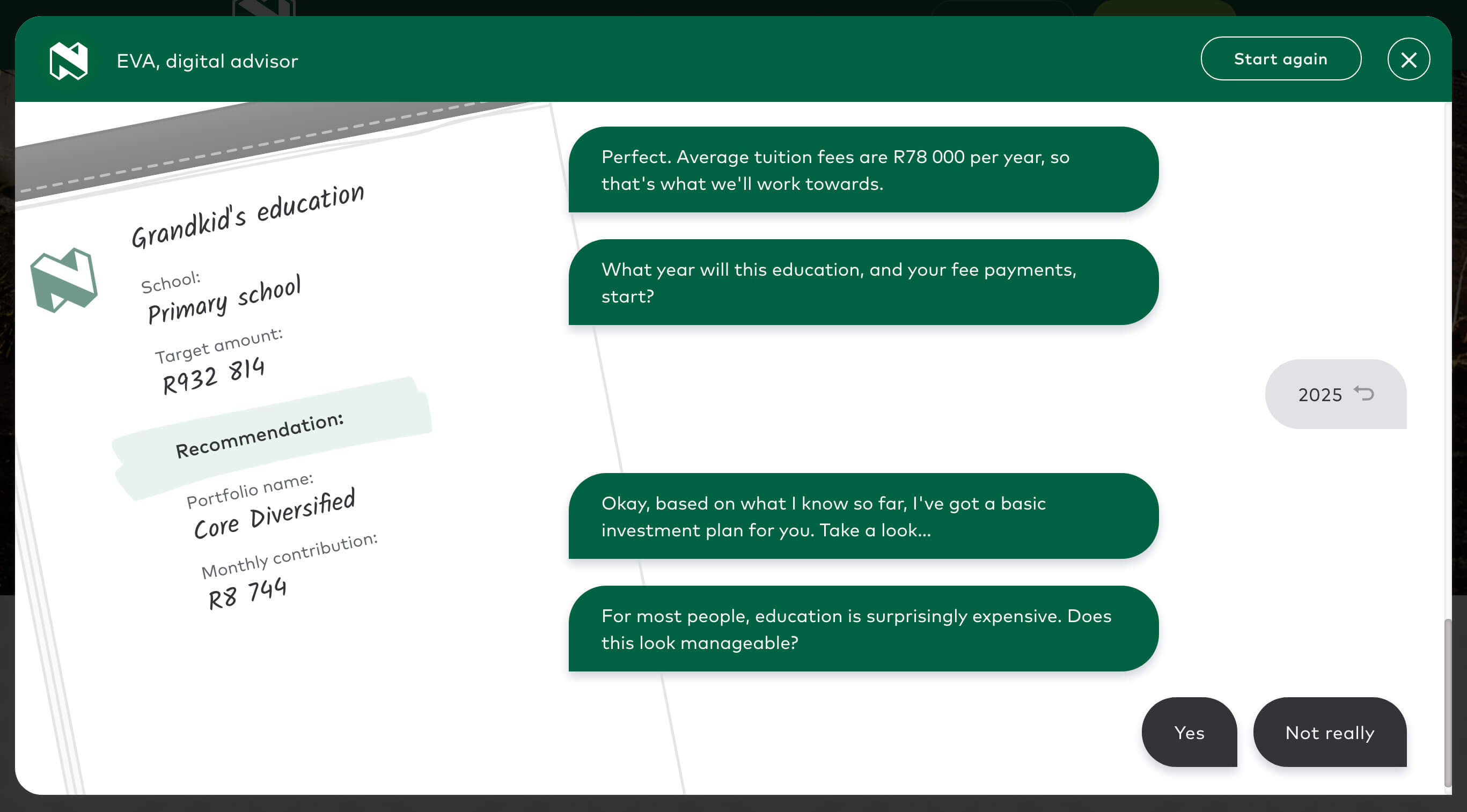

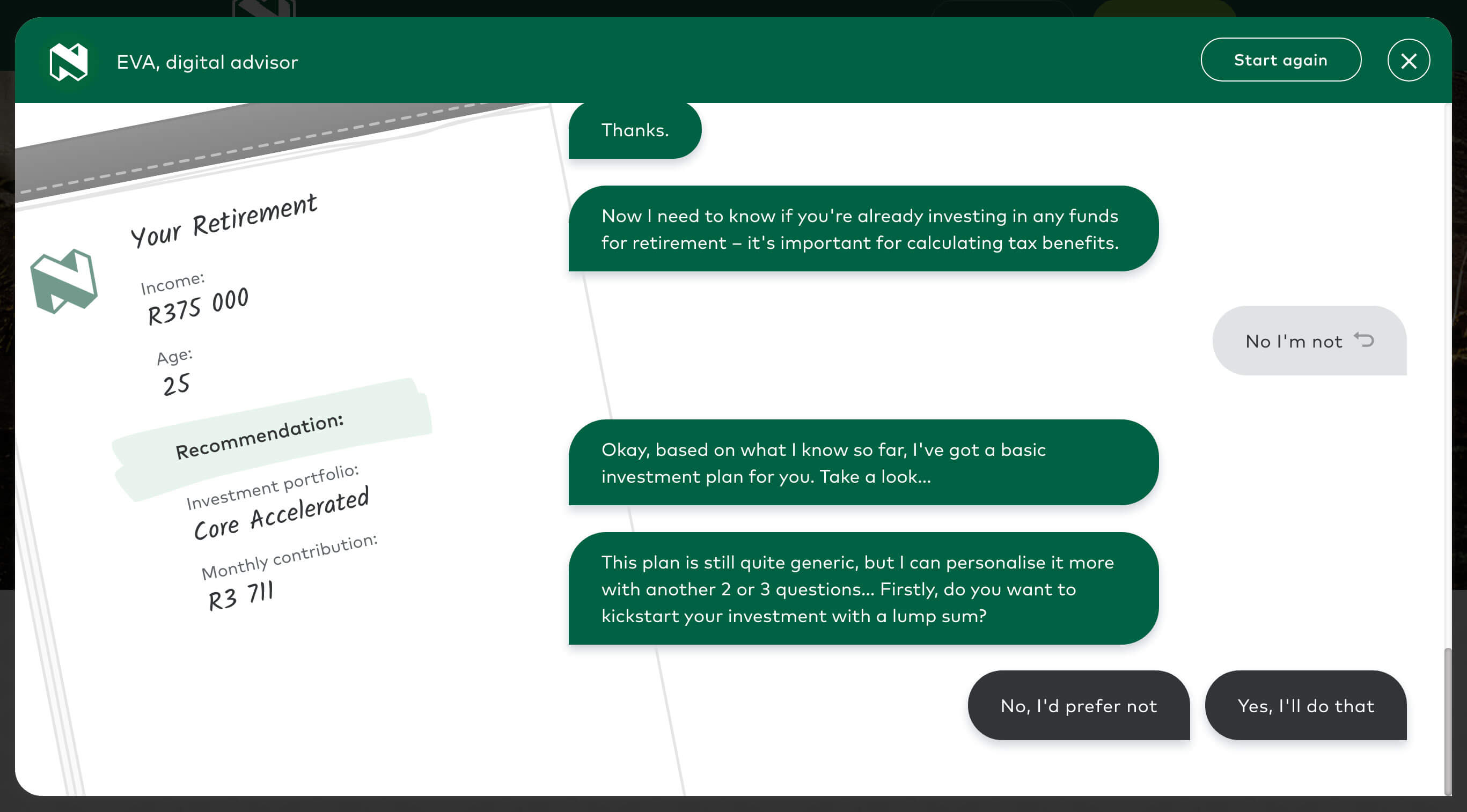

3 pathways were selected for phase 1, based on the most common reasons for wanting to invest: retirement, education, and a personal goal (e.g. a holiday). A fourth flow was later added to allow a user to ‘just save’ with no specific goal in mind.

Feature Highlights

- Interactive map to pick a school.

- Capturing salary, age, kid’s names etc.

- Assessing risk aversion based on questions the digital advisor asks

- Highly integrated with Nedbank APIs and with our international partner’s APIs.

- Obtain a personalised investment recommendation for a specific goal: saving for retirement, saving for your child’s education or saving for a personal goal such as a holiday.

- Also provide advice to people who have a set amount in mind they wish to save, without a specific goal.

- Recognises the user’s location and recommends schools

- Recommends school based on fee structure and needs

- Quick and simple - a few clicks instead of endless forms.

- Instant recommendation - no waiting.

- If the recommendation is appealing, the user can pass from the chat experience directly into digital onboarding to sign up for the investment.

Robo Advisor

The digital advisor needed to include mechanisms to set it apart and make an often tedious process feel exciting. Elements such interactive facial analysis software/tool to ‘guess your age’ rather than just asking how old you are were incorporated to make the experience more engaging. Makes capturing details more interesting through mechanisms such as.

3 pathways were selected for phase 1, based on the most common reasons for wanting to invest: retirement, education, and a personal goal (e.g. a holiday). A fourth flow was later added to allow a user to ‘just save’ with no specific goal in mind.

Personalised Investment Recommendations

Atura also provided a platform to facilitate direct chat with a financial advisor. Once a user receives their recommendation via the digital advisor, they may choose to sign up for it. Once invested, they may log back in to view various pieces of information about their investment, and track how it is growing. Atura provided the ability to chat with a financial advisor here.

Architecture

Technical Requirements

To ensure the success of Robo Advisor, the following technical requirements needed to be met:

Mobile-friendly, Low latency, Secure digital advisor, available 24/7. A short conversational interface to capture key pieces of information to be used in the needs analysis algorithms. Advice, sign up, management.

Tools

- ES6 JavaScript

- ASP.NET

- Google Location API integration

- Nedbank Nedsecure API integration

- Microsoft Face API integration for facial recognition

- Webpack

- SCSS

- CosmosDB

- Microsoft Bot Framework

- Application Insights

- Custom built webchat

- Microsoft Service Bus

Useful technical features

Microsoft Bot Framework

We used ASP.NET, Azure and the Microsoft Bot Framework to build our chat bot because of the seamless integration between these respective parts. Azure offers us easy ways to scale and maintain reliable services, with Bot Framework providing integration into various chat platforms.

Custom JavaScript webchat

The ability for us to use our own custom JavaScript webchat. We keep the user up to date on their recommendation with our custom built summary, that dynamically updates as the user answers questions about their financial goals and profile.

Custom Components

We have chosen to combine our own custom components and the built in functionality provided by services such as Bot Framework and Azure in order to achieve a uniquely functional robotic advice experience for the user.

Facial Recognition API and Google Location API

We integrate with multiple external APIs, such as Microsoft’s Facial Recognition API and Google Location API, to keep the experience fun for the user and provide the best advice we can.